Copyright © 2018 TimothySykes™ All Rights Reserved.

Disclaimer - Privacy Policy - Earnings Claims Disclosure

Millionaire Media 80 S.W. 8th Street Suite 2000 Miami, Florida 33130 United States (203) 980-1361

Risk Disclosure

This is for information purposes only as Millionaire Media LLC nor Timothy Sykes is registered as a securities broker-dealer or an investment adviser. No information herein is intended as securities brokerage, investment, tax, accounting or legal advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund. Millionaire Media LLC and Timothy Sykes cannot and does not assess, verify or guarantee the adequacy, accuracy or completeness of any information, the suitability or profitability of any particular investment, or the potential value of any investment or informational source. The reader bears responsibility for his/her own investment research and decisions, should seek the advice of a qualified securities professional before making any investment, and investigate and fully understand any and all risks before investing. Millionaire Media LLC and Timothy Sykes in no way warrants the solvency, financial condition, or investment advisability of any of the securities mentioned in communications or websites. In addition, Millionaire Media LLC and Timothy Sykes accepts no liability whatsoever for any direct or consequential loss arising from any use of this information. This information is not intended to be used as the sole basis of any investment decision, nor should it be construed as advice designed to meet the investment needs of any particular investor. Past performance is not necessarily indicative of future returns.

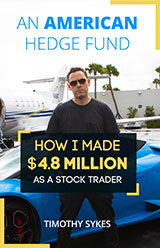

DISCLAIMER: The trading profit figures stated are my personal profit figures. Please understand my results are not typical, I’m not implying you’ll duplicate them (or do anything for that matter). I have the benefit of trading stocks for 20 years, and have an established following as a result. The average person who trades stocks get little to no results - 90% of traders lose money. I’m using these references for example purposes only. Your results will vary and depend on many factors …including but not limited to your background, experience, and work ethic. The stock market entails risk as well as massive and consistent effort and action. If you're not willing to accept that, please DO NOT GET THIS BOOK.

You will receive my book for free, once you fill out your information. From time to time, I will send you emails offering premium educational programs. You do not have to purchase them or anything to get my free book. Purchasing any of my premium courses is 100% optional.